Stay Informed with RAS News and reports, latest headlines & action

View our updated infographics on industry changes, government announcements, and recent data.

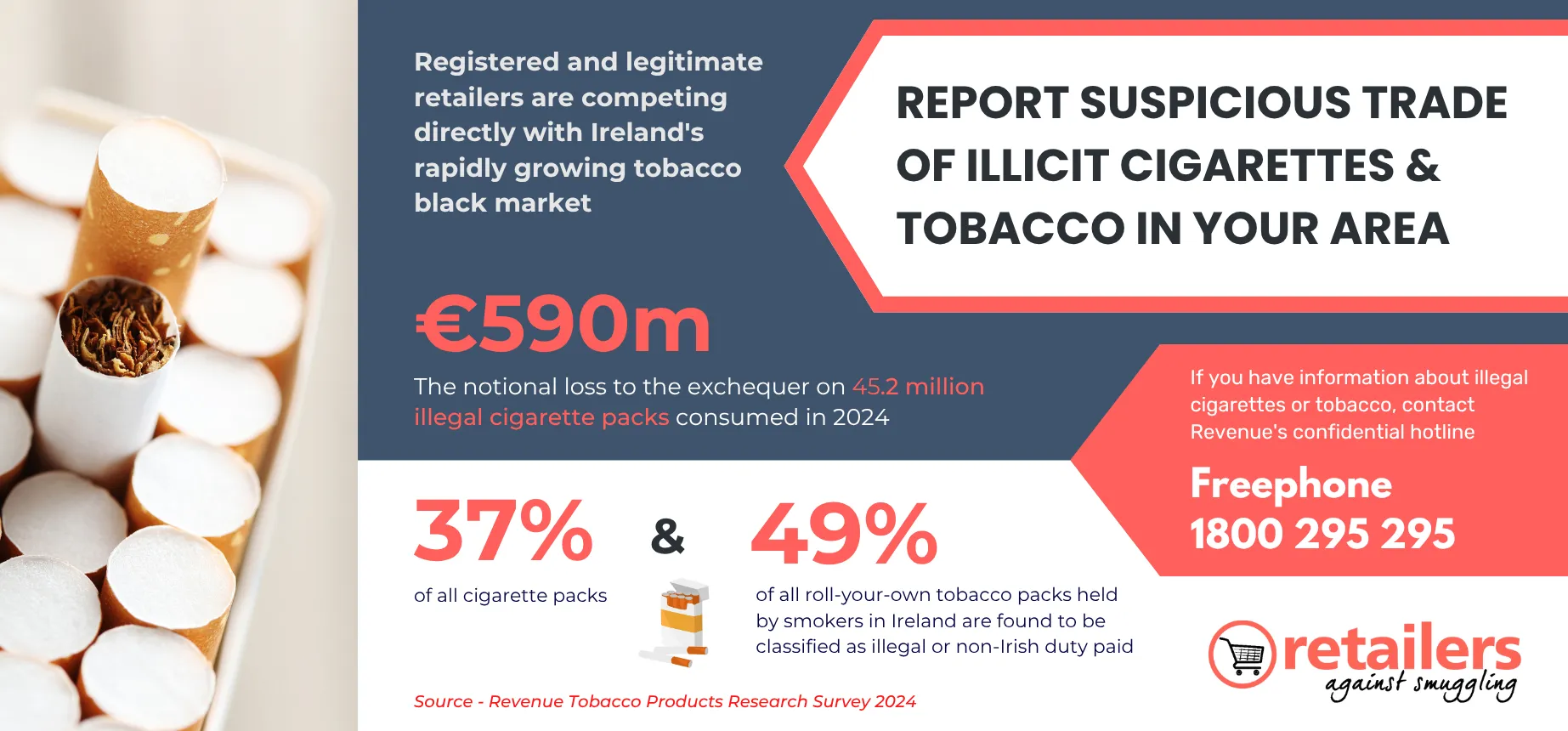

Registered and legitimate retailers are competing directly with Ireland's rapidly growing tobacco black market

View Latest Explore All Infographics1Illicit Trade - What is it?

- Illicit trade encompasses the illegal production, distribution, and sale of goods that evade legal regulations and taxation.

- In Ireland, this issue is particularly prevalent in the tobacco and fuel sectors, where products are smuggled, counterfeited, or sold for non-personal consumption without paying the required excise duties.

2The consequences of tobacco smuggling and illicit trade

Economic Impact on Retailers and Communities

Tobacco sales don’t just generate direct revenue and margin for retailers; they also drive footfall into retail stores resulting in additional purchases. If the Government does not act to crack down on Ireland’s untaxed tobacco market, then many legitimate retailers will close, resulting in local communities losing their local retail outlet.

Loss of Government Revenue

The state misses out on hundreds of millions in excise duty annually, tax which could be used to fund critical public services and be put back into the economy.

Funding for Organised Crime

Tobacco smuggling can generate significant profits for criminal organisations, which in turn, are often used to fund other criminal activities such as human trafficking, money laundering, terrorism, and organised crime syndicates.

Risks to Public Health and Safety

It endangers public health and the safety of citizens, as smuggled goods are not subject to regulatory or quality control, so there is a risk that they contain inferior, illegal, or harmful substances.

3The main causes

-

Ireland has the highest weighted average price for cigarettes among Western and Eastern European countries and Ukraine.

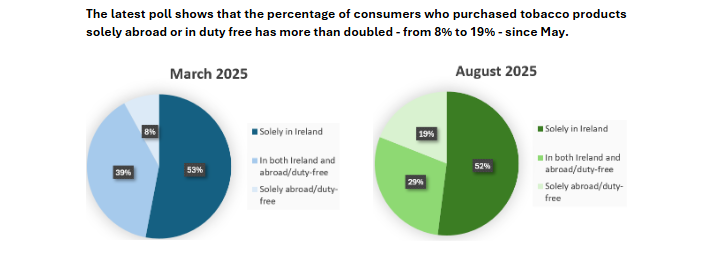

- Excise increases are fuelling illicit market activity, as they drive consumers to turn to the illicit market to purchase cigarettes. In Budget 2025, excise on a pack of cigarettes jumped by €1.00, compared to increases of €0.75 in Budget 2024, and increases of €0.50 in preceding years.

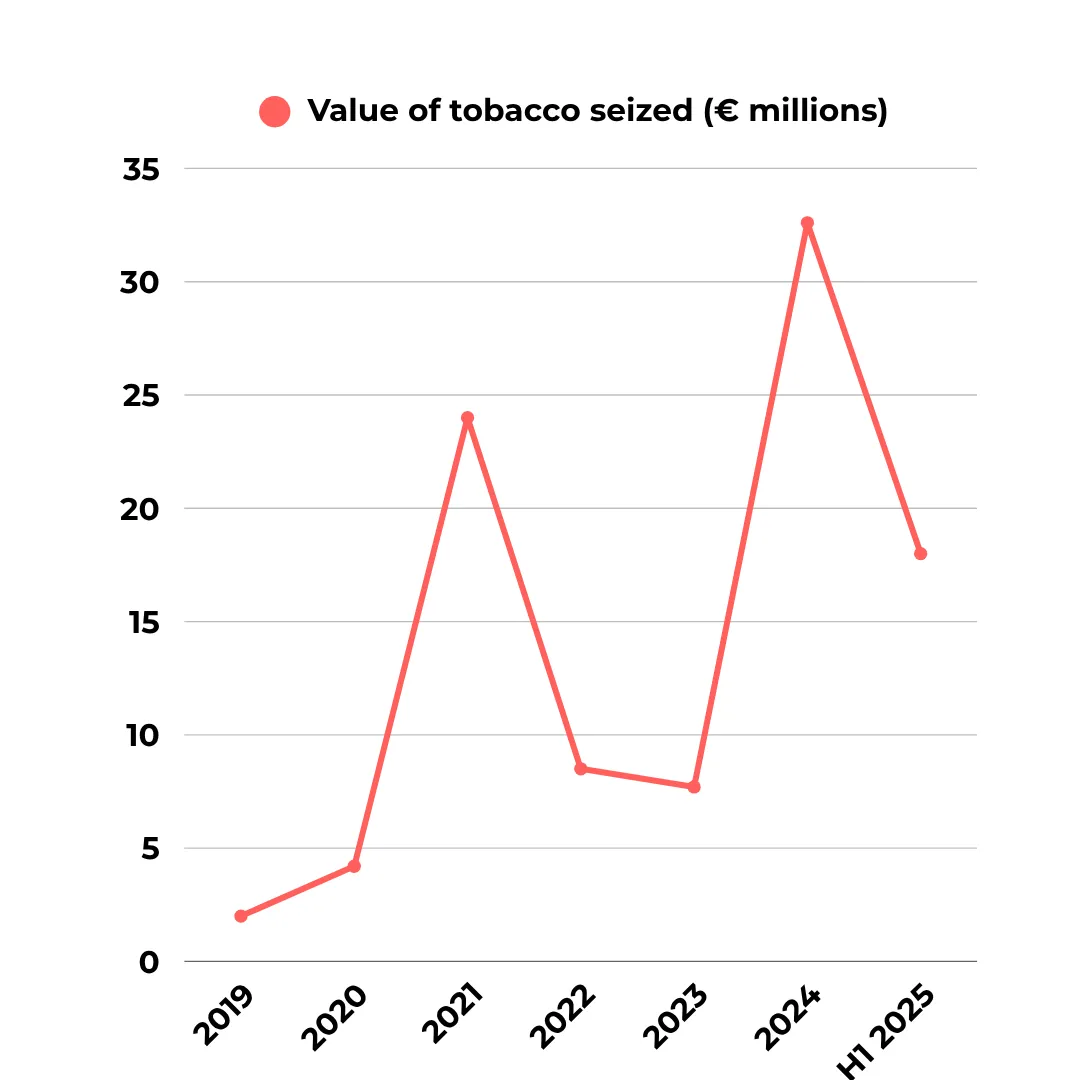

- Current resources for the detection of tobacco smuggling and enforcement of duty free and travel limits insufficient. The number of airport passengers has increased by 25.6% between 2022 and 2024, and the number of freight arrivals into has increased by 1.2% in the same period, but the number of Revenue Frontier staff has decreased by 14.6%.

Canary Islands

€3.40 RSP,

€3.41 RMC

| Table 1 | 2022 | 2023 | 2024 | Change 22-24 |

|---|---|---|---|---|

| Passenger arrivals into Irish airports | 16,303,383 | 19,585,640 | 20,478,916 | 25.6% |

| Aggregate Ro-Ro & Lo-Lo unit arrivals into Irish ports | 894,952 | 878,018 | 905,921 | 1.2% |

| Revenue Frontier staff | 632 | 625 | 540 | -14.6% |

4Economic Costs of Smuggling and Illicit Trade

Smuggling and illicit trade damages livelihoods, hurts businesses and supports criminality.

- Smuggling and illicit trade damages livelihoods, hurts businesses and supports criminality.

- It is vital that we all work with retailers, An Garda Síochána, the Revenue Commissioners, and Customs enforcement officers to tackle this problem.

5RAS Budget Proposals

1. Introduce a freeze on Tobacco Products Tax to halt the growth of Ireland's untaxed tobacco market

A freeze on the Tobacco Products tax would have no cost to the exchequer, but may result in reduced future tax losses, and possibly even an increase in revenue to the exchequer.

2. Recruit 250 additional frontier staff and purchase additional scanners to detect illegal tobacco and to enforce duty-free and travel allowances

This will provide a more visible and effective deterrent and enforcement capacity at Ireland's ports and airports and bring the staff-to-arrivals ration back to where it was in 2022.

Three additional mobile container scanners and an additional backscatter van should be purchased to double the number of scans on freight arrivals into Irish ports.

3. Increase the fines and prison sentences for court convictions for illegal smuggling.

Retailers Against Smuggling proposes that the Finance Act 2005 be amended to increase the maximum penalties for those found guilty of an offence relating to the offer, sale or delivery of non-duty paid tobacco, as follows.

- To increase the maximum fine, on summary conviction, from €1,900 to €5,000.

- To increase the maximum fine, on conviction on indictment, from €12,695 to €50,000.

- To increase the maximum term of imprisonment, on conviction on indictment from 5 years to 10 years.

In legislative terms, this proposal would amend the Finance Act 2005 as follows:

- Amend section 78 (5) (a) by substitution of “€5,000” for “€1,900”.

- Amend section 78 (5) (a) by substitution of “€50,000” for “€12,695”.

- Amend section 78 (5) (b) by substitution of “10 years” for “5 years”

6RAS Activities

Retailers Against Smuggling (RAS) was set up in June 2009 to represent retailers in the fight against the black market in Ireland. Retailers Against Smuggling represents over 3,000 small and medium sized retailers across the country. RAS aims to generate widespread awareness amongst the public, media and decision makers of the impact of smuggled alcohol, tobacco products, solid fuel, and other products on legitimate local retailers in Ireland.

1. Lobbying

RAS actively engages with government bodies, policymakers, and regulatory authorities to push for stronger enforcement and legislative solutions to tackle the illicit trade of alcohol, tobacco, solid fuel, and other products.

2. Public Awareness Campaigns

RAS runs national and local media campaigns to educate the public and policymakers about the damaging effects of smuggling on legitimate businesses, public health, and the Irish economy. These efforts help ensure the issue remains visible and urgent.

3. Media Engagement

By partnering with news outlets and journalists, RAS amplifies the voices of affected retailers and provides commentary and data to inform the public debate on smuggling and enforcement gaps.

4. Retailer Support and Mobilization

RAS gives retailers the tools and platform to share their experiences, raise concerns, and take part in collective action. This includes awareness materials, meetings, and support in engaging with authorities and communities.

5. Collaboration with Law Enforcement

RAS collaborates with authorities by sharing information from retailers on illicit trade and smuggling, helping to highlight trends, and encouraging better-targeted enforcement actions. This open line of communication is critical to ensuring that offenders are caught and held accoutable for their offences.

If you have information about illegal cigarettes or tobacco, contact Revenue's confidential hotline

Freephone

1800 295 295

Call now